- TI nspire

[TI-nspire] irr, mirr 내부수익률, 수정된 내부수익률 의 계산

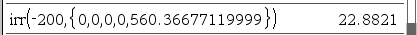

1. irr()

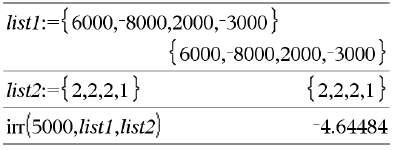

irr(CF0,CFList [,CFFreq]) ⇒ value

irr 함수는 투자의 **내부 수익률(IRR)**을 계산하는 재무 함수입니다.

- CF0: 초기 현금 흐름(시간 0)이며 실수여야 합니다.

- CFList: 초기 현금 흐름(CF0) 이후의 현금 흐름 금액 목록입니다.

- CFFreq: (선택 사항) 각 요소가 그룹화된 (연속적인) 현금 흐름 금액의 발생 빈도를 지정하는 목록입니다. 이는 CFList의 해당 요소와 일치합니다. 기본값은 1이며, 값을 입력할 경우 10,000 미만의 양의 정수여야 합니다.

2. mirr()

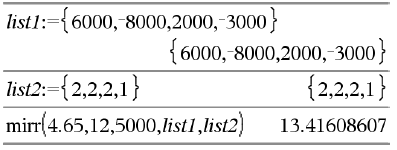

mirr(financeRate,reinvestRate,CF0,CFList[,CFFreq])

조정 내부 수익률(Modified Internal Rate of Return, MIRR)을 반환하는 재무 함수입니다.

- financeRate : 현금 흐름 금액에 대해 지불하는 이자율입니다.

- reinvestRate : 현금 흐름을 재투자할 때 적용하는 이자율입니다.

- CF0 : 초기 현금 흐름(시간 0)이며 실수여야 합니다.

- CFList : 초기 현금 흐름(CF0) 이후의 현금 흐름 금액 목록입니다.

- CFFreq : : (선택 사항) 각 요소가 그룹화된 (연속적인) 현금 흐름 금액의 발생 빈도를 지정하는 목록입니다. 이는 CFList의 해당 요소와 일치합니다. 기본값은 1이며, 값을 입력할 경우 10,000 미만의 양의 정수여야 합니다.

IRR과의 차이점:

- IRR은 모든 현금 흐름이 IRR 자체와 동일한 이자율로 재투자된다는 가정을 합니다.

- MIRR은 현금 흐름을 재투자할 때 사용하는 이자율(reinvestRate)을 별도로 고려하여 보다 사실적인 내부 수익률을 계산합니다.

3. 예제

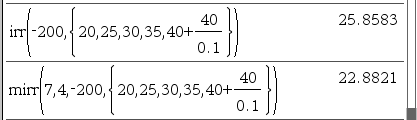

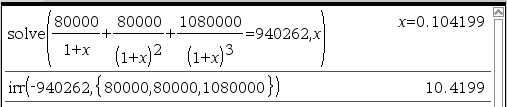

- CF0 = - 200,000 (초기 투자액)

- CF1 = 20,000

- CF2 = 25,000

- CF3 = 30,000

- CF4 = 35,000

- CF5 = 40,000 + (40,000/0.1)

- IRR = ?

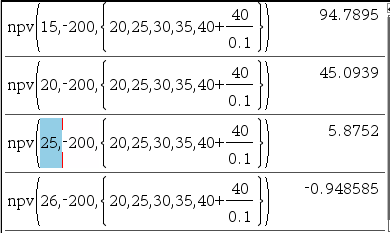

- I (InvestRate=financeRate) = 7 %, RI (ReInvestRate) = 4 %, MIRR = ?

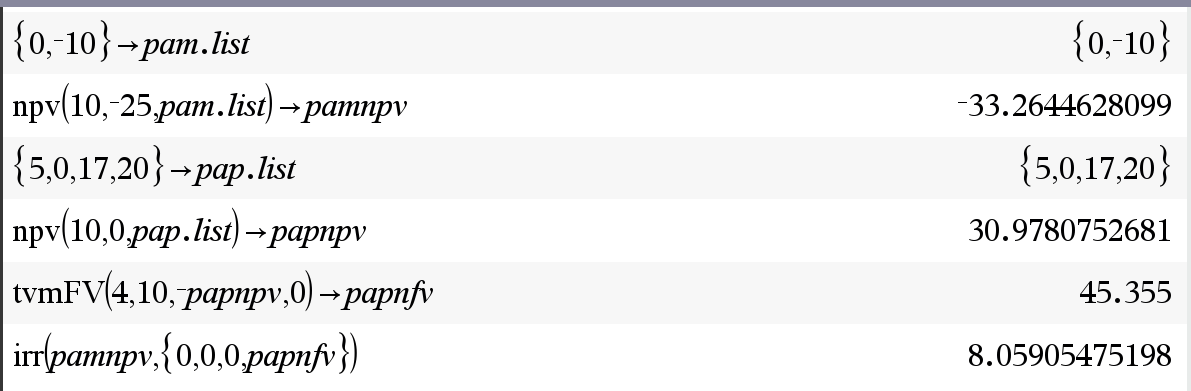

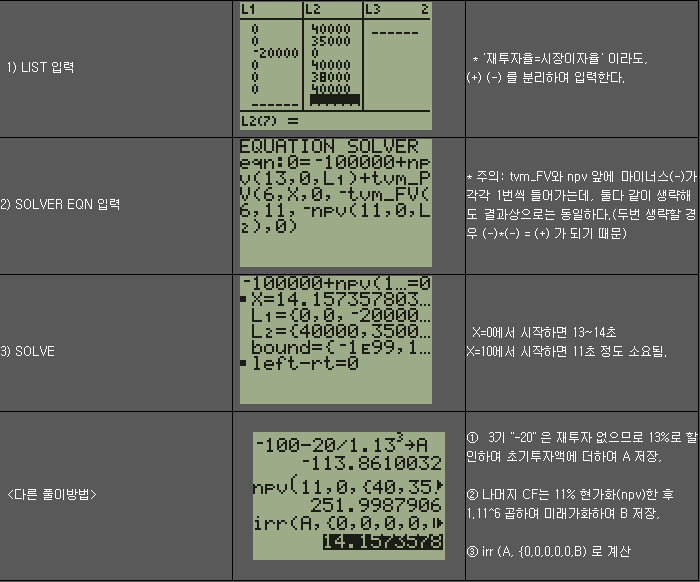

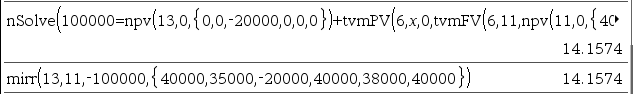

※ irr()만 있고, mirr() 기능이 없는 계산기에서의 계산 방법

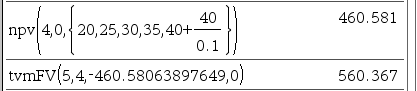

- 매기 현금흐름 중에서

1.1 【+(플러스) 현금흐름】은 재투자율로 미래가치로 계산,

└ nspire에는 nfv() 함수가 없으므로 npv() tvmfv() 2단계 거침.

tvmfv() 2단계 거침.

1.2 【-(마이너스) 현금흐름】은 (내부수익률이 아닌!) 시장이자율로 현재가치로 계산

- 【초기투자액】 + 【-(마이너스) 현금흐름】 현가 = 【+현금흐름】 재투자후 미래가치의 현가

를 만족하는 irr 값을 찾으면 그것이 MIRR

댓글7

-

1

-

1

-

세상의모든계산기

http://kin.naver.com/qna/detail.nhn?d1id=11&dirId=1113&docId=235021440

├ IRR 기능이 없다면, Solve() 기능으로 찾을 수도 있습니다.

└ 단, IRR 은 해가 여러개일 수 있으므로 주의하여야 합니다. -

세상의모든계산기

본문의 예제(irr 구하기)를 시행착오법으로 구하려 한다면, 시도(try)할 값을 npv() 의 I% 에 하나씩 대입해 풀면 됩니다.

정확한 값을 구할 수 있는데, 굳이 이 방법을 쓸 이유는 없겠습니다. 문제에서 요구한 것이 아니라면 말이죠.

-

세상의모든계산기

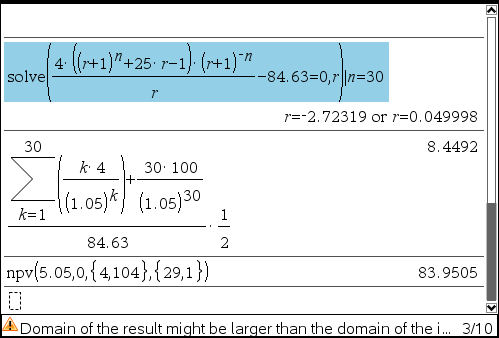

채권의 만기수익률 & 맥콜레이 듀레이션

http://kin.naver.com/qna/detail.nhn?d1id=11&dirId=1113&docId=239432530

-

세상의모든계산기

재무 계산기(BA II Plus)에서 MIRR 계산 동영상

https://www.youtube.com/watch?v=SGeWLQIMxc4&ab_channel=FIN-Ed

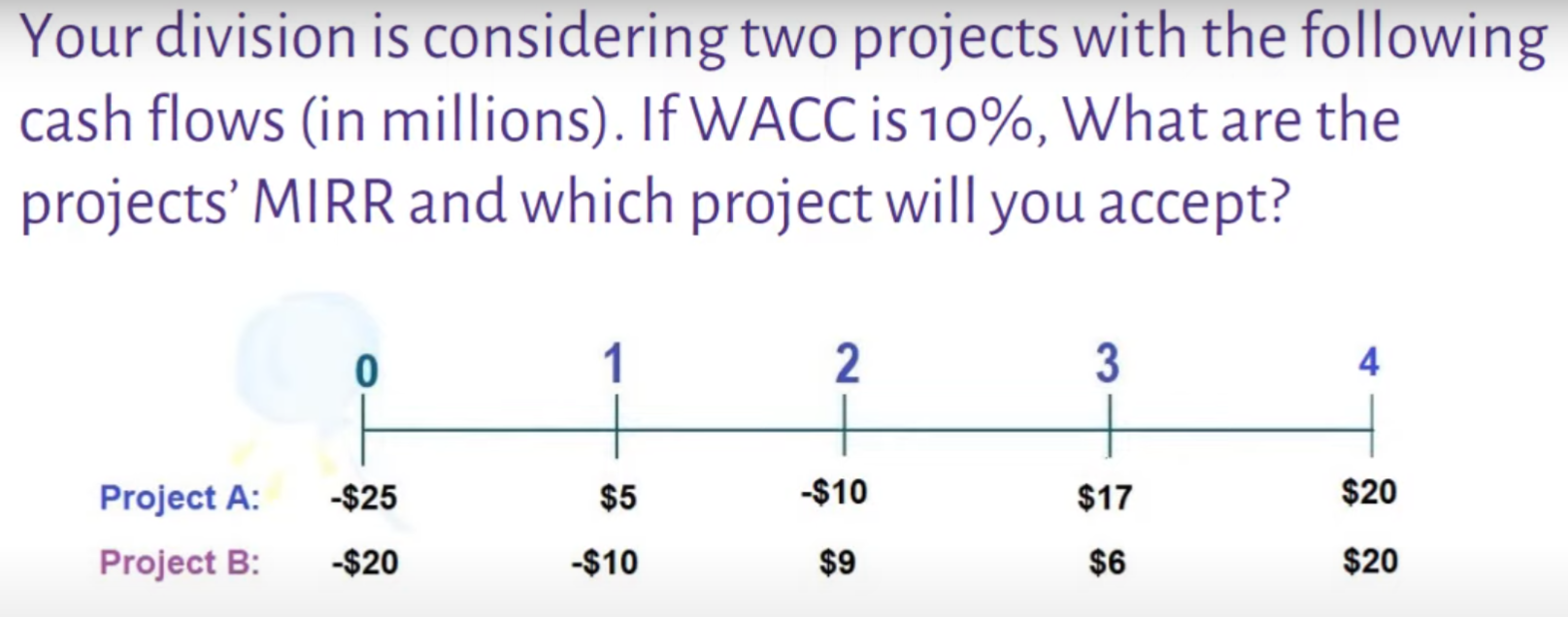

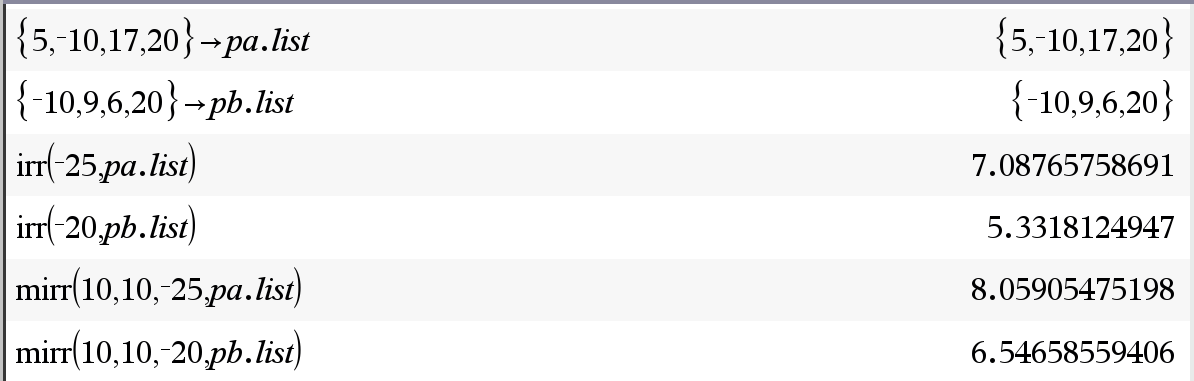

영상 속에서는, WACC=10% 를 사용하여 자본이자율=재투자율=10% 인 것으로 계산하였네요.

ㄴ Project A, B 에 대해 각각 이런 결론이 나온 셈이구요.Project A만 따로 계산해 보면 아래의 과정을 거쳐 나왔습니다.

세상의모든계산기 님의 최근 댓글

쌀집계산기로 연립방정식 계산하기 - 크래머/크레이머/크라메르 공식 적용 https://allcalc.org/56739 3. 'x' 값 구하기 계산기 조작법 목표: x = Dx / D = [(c×e) - (b×f)] / [(a×e) - (b×d)] 계산하기 1단계: 분모 D 계산 (메모리 활용) 1 * 1 M+ : 메모리(M)에 1를 더합니다. (현재 M = 1) -0.1 * -0.2 M- : 메모리(M)에서 0.02를 뺍니다. (현재 M = 0.98 = 0.98) 이로써 메모리(MR)에는 분모 0.98가 저장됩니다. 2단계: 분자 Dx 계산 후 나누기 78000 * 1 : 78000를 계산합니다. = : GT에 더합니다. -0.1 * 200000 : -20000를 계산합니다. ± = : 부호를 뒤집어 GT에 넣습니다. // sign changer 버튼 사용 GT : GT를 불러옵니다. GT는 98000 (분자 Dx) 값입니다. ÷ MR = : 위 결과(98000)를 메모리(MR)에 저장된 분모 D(0.98)로 나누어 최종 x값 100,000를 구합니다. 4. 'y' 값 구하기 계산기 조작법 목표: y = Dy / D = [(a×f) - (c×d)] / [(a×e) - (b×d)] 계산하기 1단계: 분모 D 계산 (메모리 활용) 'x'에서와 분모는 동일하고 메모리(MR)에 0.98가 저장되어 있으므로 패스합니다. 2단계: 분자 Dy 계산 후 나누기 GT ± = : GT를 불러오고 부호를 뒤집어 GT에 더합니다. GT가 0으로 리셋됩니다. 【AC】를 누르면 M은 유지되고 GT만 리셋되는 계산기도 있으니 확인해 보세요. 1 * 200000 : 200000를 계산합니다. = : GT에 더합니다. 78000 * -0.2 : -15600를 계산합니다. ± = : 부호를 뒤집어 GT에 넣습니다. GT : GT를 불러옵니다. 215600 (분자 Dy) 값입니다. ÷ MR = : 위 결과(215600)를 메모리(MR)에 저장된 분모 D(0.98)로 나누어 최종 y값 220,000를 구합니다. x, y 값을 이용해 최종 결과를 구합니다. 2026 01.18 크레이머 = 크레머 = 크라메르 공식 = Cramer's Rule https://allcalc.org/8985 2026 01.18 부호 변경 버튼 https://allcalc.org/52092 2026 01.18 [fx-570 CW] 와의 차이 CW에 【×10x】버튼이 사라진 것은 아닌데, 버튼을 누를 때 [ES][EX] 처럼 특수기호 뭉치가 생성되는 것이 아니고, 【×】【1】【0】【xㅁ】 버튼이 차례로 눌린 효과가 발생됨. ※ 계산 우선순위 차이가 발생할 수 있으므로 주의. 괄호로 해결할 것! 2026 01.18 26년 1월 기준 국가 전문자격 종류 가맹거래사 감정사 감정평가사 검량사 검수사 경매사 경비지도사 경영지도사 공인노무사 공인중개사 관광통역안내사 관세사 국가유산수리기능자(24종목) 국가유산수리기술자 국내여행안내사 기술지도사 농산물품질관리사 물류관리사 박물관 및 미술관 준학예사 변리사 사회복지사 1급 산업보건지도사 산업안전지도사 세무사 소방시설관리사 소방안전교육사 손해평가사 수산물품질관리사 정수시설운영관리사 주택관리사보 청소년상담사 청소년지도사 한국어교육능력검정시험 행정사 호텔경영사 호텔관리사 호텔서비스사 2026 01.17